Quality

Accounting services are all about quality and precision, with years of experience we can offer that...

Solutions

We have an array of services for your personal and business accounting needs...

Consultant Tax Information

A consultant most often works as an independent contractor and is not treated as an employee by the employing company. This is attractive to the company, because it reduces costs. It further has a significant impact on the consultant's tax return, and is reflected in the total amount of taxes that must be paid.

Income Tax

A consultant working as an independent contractor is not an employee of the company. Rather than receiving a W-2 form that shows federal tax, state tax, Social Security and Medicare withholdings, the independent contractor receives a 1099-MISC form, which shows only the total compensation paid. The income is reported on Form 1040, Schedule C, the self-employment schedule. The gross income from the 1099-MISC is reported. Business expenses such as licenses, advertising, insurance, mileage, etc. are listed and subtracted from the the gross income to report the net income. The advantage to the independent contractor consultant is that many types of business expenses can be deducted. The net income from Schedule C is carried to the Form 1040, where it is added to all other forms of income.

Sale Tax

A tax imposed by the government at the point of sale on retail goods and services. It is collected by the retailer and passed on to the state.

What is E-filing?

Electronic filing ("hereinafter e-filing") is the filing of

information in electronic form, as opposed to paper form. E-filing

will likely have a more pervasive effect on the legal system than did

the adoption of administrative procedure acts or codes of civil

procedure. It will require fundamental changes in organization,

operation, management, and resource utilization by courts, lawyers,

clients, citizens, and government entities.

Electronic filing ("hereinafter e-filing") is the filing of

information in electronic form, as opposed to paper form. E-filing

will likely have a more pervasive effect on the legal system than did

the adoption of administrative procedure acts or codes of civil

procedure. It will require fundamental changes in organization,

operation, management, and resource utilization by courts, lawyers,

clients, citizens, and government entities.

Before analyzing the basis for such a sweeping statement, it is

proper to begin at a common starting point. Traditionally, filings in

courts and government agencies have been in paper form.3 Official

court record systems have traditionally been paper-based.4

Value-Added Tax - VAT A type of consumption tax that is placed on a product whenever value is added at a stage of production and at final sale. Value-added tax (VAT) is most often used in the European Union. The amount of value-added tax that the user pays is the cost of the product, less any of the costs of materials used in the product that have already been taxed.

Value Added Taxes (VAT) in India

Value Added Tax (VAT) is nothing but a general consumption tax that is assessed on the value added to goods & services. It is the indirect tax on the consumption of the goods, paid by its original producers upon the change in goods or upon the transfer of the goods to its ultimate consumers. It is based on the value of the goods, added by the transferor. It is the tax in relation to the difference of the value added by the transferor and not just a profit.

Value Added Tax (VAT) is nothing but a general consumption tax that is assessed on the value added to goods & services. It is the indirect tax on the consumption of the goods, paid by its original producers upon the change in goods or upon the transfer of the goods to its ultimate consumers. It is based on the value of the goods, added by the transferor. It is the tax in relation to the difference of the value added by the transferor and not just a profit.

All over the world, VAT is payable on the goods and services as they form a part of national GDP. More than130 countries worldwide have introduced VAT over the past 3 decades; India being amongst the last few to introduce it.

It means every seller of goods and service providers charges the tax after availing the input tax credit. It is the form of collecting sales tax under which tax is collected in each stage on the value added of the goods. In practice, the dealer charges the tax on the full price of the goods, sold to the consumer and at every end of the tax period reduces the tax collected on sale and tax charged to him by the dealers from whom he purchased the goods and deposits such amount of tax in government treasury.

VAT is a multi-stage tax, levied only on value that is added at each stage in the cycle of production of goods and services with the provision of a set-off for the tax paid at earlier stages in the cycle/chain. The aim is to avoid 'cascading', which can have a snowballing effect on the prices. It is assumed that because of cross-checking in a multi-staged tax; tax evasion would be checked, hence resulting in higher revenues to the government.

Importance of VAT in India

India, particularly being a trading community, has always believed in accepting and adopting loopholes in any system administered by State or Centre. If a well-administered system comes in, it will not only close options for traders and businessmen to evade paying their taxes, but also make sure that they'll be compelled to keep proper records of sales and purchases.

Under the VAT system, no exemptions are given and a tax will be levied at every stage of manufacture of a product. At every stage of value-addition, the tax that is levied on the inputs can be claimed back from tax authorities.

At a macro level, two issues make the introduction of VAT critical for India

Industry watchers believe that the VAT system, if enforced properly, will form part of the fiscal consolidation strategy for the country. It could, in fact, help address issues like fiscal deficit problem. Also the revenues estimated to be collected can actually mean lowering of fiscal deficit burden for the government.

International Monetary Fund (IMF), in the semi-annual World Economic Outlook expressed its concern for India's large fiscal deficit - at 10 per cent of GDP.

Moreover any globally accepted tax administrative system would only help India integrate better in the World Trade Organization regime.

Advantages of VAT

Coverage If the tax is considered on a retail level, it offers all the economic advantages of a tax of the entire retail price within its scope. The direct payment of tax spreads out over a large number of firms instead of being concentrated only on particular groups, such as wholesalers & retailers.

Revenue Security - Under VAT only buyers at the final stage have an interest in undervaluing their purchases, as the deduction system ensures that buyers at earlier stages are refunded the taxes on their purchases. Therefore, tax losses due to undervaluation will be limited to the value added at the last stage.

Secondly, under VAT, if the payment of tax is avoided at one stage nothing will be lost if it is picked up at later stage. Even if it is not picked up later, the government will at least have collected the VAT paid at previous stages. Where as if evasion takes place at the final/last stage the state will lose only tax on the value added at that particular point.

Selectivity - VAT is selectively applied to specific goods & business entities. In addition, VAT does not burden capital goods because of the consumption-type. VAT gives full credit for tax included on purchases of capital goods.

Co-ordination of VAT with direct taxation - Most taxpayers cheat on sales not to evade VAT but to evade their personal and corporate income taxes. Operation of VAT resembles that of the income tax and an effective VAT greatly helps in income tax administration and revenue collection.

Disadvantages of VAT

VAT is regressive

VAT is difficult to operate from position of both administration and business

VAT is inflationary

VAT favors capital intensive firms

Items covered under VAT

All business transactions that are carried on within a State by individuals/partnerships/ companies etc. will be covered under VAT.

More than 550 items are covered under the new Indian VAT regime out of which 46 natural & unprocessed local products will be exempt from VAT

Nearly 270 items including drugs and medicines, all industrial and agricultural inputs, capital goods as well as declared goods would attract 4 % VAT in India.

The remaining items would attract 12.5 % VAT. Precious metals such as gold and bullion will be taxed at 1%.

Petrol and diesel are kept out of the VAT regime in India.

Service tax in India

When we use any service be it a phone

bill payment or Hire a room in a hotel we have to pay out little more

than the actual rates charged. Ever wondered why? The reason is very

meek, we are made to pay service tax over and above the usual charge but

the bigger question is What is Service Tax, why do we have to pay Service Tax when the tax is applicable on the company providing the service and what is the Service Tax Rate. If this question bothers you, find answers below.

What is Service Tax?

Service Tax is a tax which is payable on services provided by the service provider. Just like Excise duty is payable on goods which are manufactured, similarly

Service Tax is payable on Services provided.

This Tax is payable by the provider of Service to the Govt. of India. However, the Service Provider can collect this Service Tax from the Consumer of Service (also referred to as Recipient of Service) and deposit the same with the Govt.

Applicability of Service Tax

Service Tax came into effect in 1994 and was introduced by the then Finance Minister Dr. Manmohan Singh. Earlier Service Tax was payable only on a

specified list of services but Pranab Mukherjee while delivering his

budget speech on 16th March 2012 announced that Service Tax would be

applicable on all services except the negative list of services.

Every Service is now required to apply for Service Tax Registration if the Value of Services provided by him during a Financial Year is

more than Rs. 9 Lakhs, but the Service Tax would be payable only when

the Value of Services provided is more than Rs. 10 Lakhs.

All service providers in India, except those in the state of Jammu and Kashmir, are required to pay a Service Tax in India. Earlier Service Tax was charged on cash basis for every service provider. Currently, it is charged on cash basis for Individual service providers and for companies it is being charged on accrual basis i.e companies liability to deposit tax arises as soon as services are provided irrespective of the collection

of funds on the same.

However Individual Service Providers

have to Deposit Service Tax only when the Invoice Amount has been

collected. Service Tax Payment is deposited by the Service Provider with

the Govt. quarterly in case of Individuals/Partnership and Monthly in

all other cases.

Service Tax Rate

The Current of Service Tax Rate is 12%

Education Cess @ 2% and Senior and Higher Education Cess @ 1% are also liable to be payable on the above Service Tax Rate.

Service Tax Rate = 12%

(+) Education Cess @ 2%†= 0.2%

(+) Senior & Higher Education Cess @ 1%†= 0.1%

Effective Service Tax Rate†= 12.36%

Service Tax is required to be deposited on a Monthly/Quarterly basis. The Service tax can be paid either by manually depositing in the Bank or through Online Payment of Service Tax. In case, of excess payment of Service Tax by the Service Provider with the Governement, the Service Provider can either adjust the excess amount paid or can claim Refund of the Excess Tax deposited. Refer: Service Tax Refund

Case Study on Service Tax

Letís understand via simple case, If a Chartered Accountant, provides services in the capacity of auditor to ABC Ltd. and the audit fees is Rs. 1,00,000 then the service tax chargeable will be 12.36% on Rs. 1,00,000 i.e. INR 12,360. Hence, the total billing to be done by CA to ABC Ltd will be INR 1, 12,360.

The segregation of Value of Service Provided (i.e. Rs. 1,00,000)and the Service Tax payable thereon (i.e. Rs. 12,360) shall be separately showing on the Invoice.

In case, no service tax is separately charged in Invoice or the service receiver makes partial payment then the service tax shall be proportionately taken to be amount as on the gross amount received by the service provider for the taxable service provided or to be provided by him.

TDS

TDS is an indirect tax. it is the tax decucted at sources

(payment) by the payer and the same amount is remuted to

the government(IT Department)

TDS is an indirect tax. it is the tax decucted at sources

(payment) by the payer and the same amount is remuted to

the government(IT Department)

payer(deducter)-The person who deduct tax and pay to

government is known as deducter. Deducter includes any

person (sec 2(31)) person ,INdividual, Huf, Body of

individuals etc and also includes government.

payee-(deductee) The person from whose income tax is

deducted is known as deductee.

following are the payments from which tax is deducted :

salary, interest on securities,interest on bank deposists

interest on post office deposist, comission, lottory

tickts, dividents on shares, horse rates income contract or

subcontract fees , Insurance comisson,rent, profession or techniacal.

it is deductible only when

deductor makes payment to deductee,

There are many types of tds

1 u/s 194 a intrest

1 u/s 192 salaries & so may u can check it out on

National website of income tax i.e. incometaxindia.gov.in

Audit Work

We undertake Audit assignments. Such Assignments could be in nature of

1. Cost Audit as under provisions of Section 209(1)(d) and Section 233B of the Companies Act 1956.2. Excise Audit as under the provisions of Section 14A & 14 AA of the Central Excise Act 1944.

3. Internal Audit.

4. MVAT Audit

5. Special audit as required.

6. Stock Audit/Monitoring Services for Banks.

7. Internal Audit of Stock Brokers.

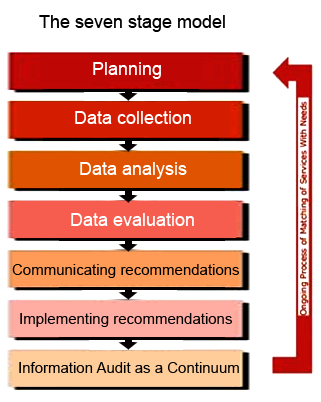

How to conduct an information audit introducing the model

Just as there is no universally accepted definition of an information audit, there is also no universally accepted model for the information audit process because of the dramatically varying structures, natures and circumstances of the organizations in which they are conducted.

The model presented here is one that was developed by the author as a result of examining the methodologies used by librarians and consultants and extracting the components necessary to achieve the objectives of an information audit.

Just as there is no universally accepted definition of an information audit, there is also no universally accepted model for the information audit process because of the dramatically varying structures, natures and circumstances of the organizations in which they are conducted.

The model presented here is one that was developed by the author as a result of examining the methodologies used by librarians and consultants and extracting the components necessary to achieve the objectives of an information audit.

The seven-stage information audit model as shown in Figure 3 takes you through the information audit process stage-by-stage highlighting those aspects of the process that are critical to its success and the issues that you may face that can impact on the value of your outcomes.

The model is not a highly structured and controlled process that operates in a tightly defined manner. Rather it is a structured framework that is flexible and can 'bend' to meet the varying conditions and constraints of an organization. In other words, the components can be 'tailored' to suit to the objectives of the organization and the resources available (Henczel, 2000).

Management Audit

A systematic assessment of methods and policies of an organization's management in the administration and the use of resources, tactical and strategic planning, and employee and organizational improvement.

A systematic assessment of methods and policies of an organization's management in the administration and the use of resources, tactical and strategic planning, and employee and organizational improvement.

The objectives of a management audit are to (1) establish the current level of effectiveness, (2) suggest improvements, and (3) lay down standards for future performance. Management auditors (employees of the company or independent consultants) do not appraise individual performance, but may critically evaluate the senior executives as a management team. See also performance audit.

Management Audit Procedures

The word "audit" is the medical equivalent to the word "enema"; that is, no one likes one, but they can greatly reduce your risk for a bad event. The key to making the audit process less painful is a good list of easy-to-follow procedures. Guidelines for management audits help to objectify the process by creating a system and a framework for reporting on findings. Creating a questionnaire to accompany the audit is perhaps the easiest way to communicate procedures.

What is project finance?

Project financing is an innovative and timely financing technique that has been used on many high-profile corporate projects, including Euro Disneyland and the Eurotunnel.

Project financing is an innovative and timely financing technique that has been used on many high-profile corporate projects, including Euro Disneyland and the Eurotunnel.

Employing a carefully engineered financing mix, it has long been used to fund large-scale natural resource projects, from pipelines and refineries to electric-generating facilities and hydro-electric projects. Increasingly, project financing is emerging as the preferred alternative to conventional methods of financing infrastructure and other large-scale projects worldwide.

Project Implementation Process (PIP)

About PIP

Typically Informatics Implementation Projects involve the implementation of a vendor software product,

a software release. a system enhancement, or an in-house developed software product. Usually, one or

more user departments are involved as well as vendor representatives, Informatics staff, and external consultants.

Prior to starting the Project Implementation Process (PIP), projects must have successfully completed the Project Evaluation Process (PEP) and the project has been approved for implementation. The Project Evaluation Process includes performing a needs analysis, and architecture review, and vendor contracting. The project evaluation could result in the definition of one or more projects to be implemented. Several distinct implementation projects rather then one large implementation could limit risk and aid in scope and resource management.

Techno Economic Viability Studies

Page Under Construction

Market Survey

A market survey is an important requirement for initiating any successful business. The objective of

a market survey is to collect information on various aspects of the business. This survey is a tool

through which we can minimize risk. After the market survey, the results must be analyzed in order

to finalize a business plan.

A market survey is an important requirement for initiating any successful business. The objective of

a market survey is to collect information on various aspects of the business. This survey is a tool

through which we can minimize risk. After the market survey, the results must be analyzed in order

to finalize a business plan.

Vender Selection

The main objective of this phase is to minimize human emotion and political positioning in order to arrive at a decision that is in the best interest of the company. Be thorough in your investigation, seek input from all stakeholders and use the following methodology to lead the team to a unified vendor selection decision:

1. Preliminary Review of All Vendor Proposals

2. Record Business Requirements and Vendor Requirements

3. Assign Importance Value for Each Requirement

4. Assign a Performance Value for Each Requirement

5. Calculate a Total Performance Score

6. Select a the Winning Vendor